Strengthen Your Credit Potential: Understanding JBT Capital Ratings

As we come to the end of tax season, there’s no better time to delve into JBT capital ratings—a credit rating that leverages data that can be found right in your company’s U.S. Corporate Tax Return or annual report.

Understanding JBT Ratings

First, let's consider the JBT credit rating. A JBT credit rating consists of two key elements: a status code and a pay score. The status code denotes the classification of a company within the JBT database, while the pay score reflects payment behavior reported by vendors. For example, let’s take a closer look at the rating “FIN1”

- FIN: Status code indicating the company’s credit report has complete information, however, financial information was not provided.

- 1: Pay score indicating prompt payment.

A JBT capital rating stands in for the status code portion of the credit rating.

What are JBT Capital Ratings?

JBT capital ratings are a specialized type of credit rating, designed to convey a company’s financial strengths and act as a supplement to the company’s pay score. While a pay score is determined by a company’s credit transactions and payment trends, capital ratings are derived from a company’s financial resources. These ratings offer a snapshot of the funds a business is working with, giving insights to vendors making credit assessments, and potentially hastening the borrower’s approval process.

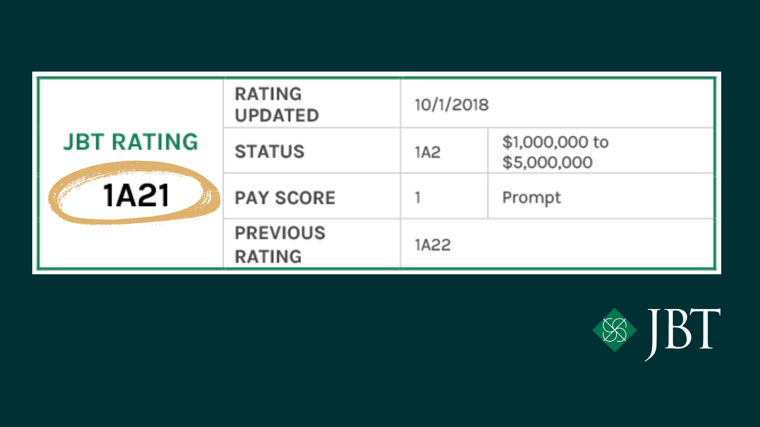

Let’s go back to our “FIN1” credit rating example. A company with a pay score of 1, after qualifying for a capital rating, may end up with a credit rating of 1A21—the "1A2" being the capital rating, designating the company as having ratable capital of $1,000,000 to $5,000,000.

Capital Rating Eligibility

To qualify for a JBT capital rating, a business must meet certain criteria. This includes being in operation for at least three years, being listed in the JBT database for a minimum of one, and supplying JBT with the past three consecutive years of financial statements. (Think fiscal year ended 2023, 2022, and 2021). This information can be provided in the form of:

- U.S. Corporate Tax Return: Pages 1-6.

- Financial Statements Prepared by a CPA: Including a cover letter from the CPA, profit and loss statement, and balance sheet.

Companies can opt to keep this information confidential, yet still provide it to JBT for a capital rating. JBT will issue a capital rating that encompasses a larger financial range, so information that you wish to keep sensitive, like last year’s sales, remain undisclosed to vendors reviewing your credit report.

The Value of Capital Ratings

Businesses choose capital ratings for a variety of reasons, most aimed at conveying a strong financial standing and bolstering credibility:

- Communicating Financial Strength: A capital rating provides an additional layer of assurance to vendors, potentially demonstrating a company’s ability to meet payment obligations.

- Enhanced Credibility: By obtaining a capital rating, companies signal their commitment to transparency and accountability, building trust among vendors.

- Offsetting Lack of Pay Score: For companies that do not purchase on credit, or do not have a pay score for other reasons, a capital rating serves as an alternative way to communicate financial standing, despite the absence of a robust credit history.

Maintaining Your Rating

Obtaining a capital rating is an on-going process. Once a company qualifies for a JBT capital rating, they must continue to provide their financial information annually and in a timely manner to maintain this rating.

Conclusion

Consider submitting your financial data to JBT to give your JBT credit rating a boost. JBT capital ratings provide your vendors with more information to work with and may expedite your approval process. A stronger credit rating unlocks opportunities for your business by means of improved service, payment terms, discounts, and product access.

If you’d like to know more about JBT capital ratings, give us a call at (401)467-0055 and ask to speak to your dedicated Analyst, or click the button below to email us.