Reduce Your Business Risk with Credit Reports

.png?width=757&height=426&name=December%20Blog%20Post%20Images%20(2).png)

2022 was a challenging time for the domestic and global economy, as rising interest rates and COVID-related supply chain problems have contributed to decades-high inflation. Now, in the second quarter of 2023, talks of a late-year recession continue to percolate, causing an even greater need for businesses to mitigate as much risk as possible. One easy but impactful way to protect your business is to use JBT’s credit reports for smarter decision-making.

The below story about a fictitious jewelry retailer, John Smith Jewelry, is based on true events, with names and circumstances changed. The hypothetical situation: John Smith Jewelry files for bankruptcy and owes its top creditors $750,000. How could the company’s creditors have used credit reports to prevent this major business headache? Let’s find out.

#1: Pull a Credit Report Before SellingJohn Smith Jewelry works with nine JBT members. Of those, only three requested a credit report before selling to the company, while:

- three members pulled a credit report only after they filed the claim

- three members never pulled a credit report at all

#2: Be Wary of Underreported Trade Payment Data

When John Smith Jewelry filed for bankruptcy, the JBT had 58 potential references (names of suppliers) on file. Of those 58 suppliers, only eight - 14% - had reported customer trade payment information over the previous seven months. Furthermore, the Bankruptcy Court report listed 18 creditors, 17 of whom were JBT members. Of the 17 members, 14 had reported no payment information to JBT.

Importantly, a supplier list provided by a customer is not equivalent to an official JBT credit report. Customers will typically provide names of only those suppliers they pay promptly, which could be relatives or related firms. When checking references, ask the creditor if they know of other businesses the customer may be working with, and check them to obtain a fuller view of payment habits.

If you’re already a JBT member, help build an even stronger ecosystem of quality data by reporting payment information to JBT - this helps to provide a clearer picture of a company’s payment habits.

#3: Pay Attention to Pay Scores

Two years before filing bankruptcy, John Smith Jewelry maintained a Pay Score of 4 (an average over 90 days past agreed-upon terms). Pay Scores are ranked: zero (no basis for Payment Score), 1 (Prompt), 2 (Good), 3 (Fair), and 4 (Slow) based upon reported payment terms.

Had more members looked at John Smith Jewelry’s credit report, they could have reduced - or prevented altogether - this exposure.

An Ounce of Prevention Is Worth a Pound of Cure…

JBT offers several ways to help you monitor your customers. While no one has a crystal ball that can predict a recession or creditworthiness, JBT can help members make better business decisions.

Start by adding them to our Credit Watch monitoring program. When credit rating changes occur, you’ll receive an email alert. Participate in Interchange and receive a monthly customized report on your customers that include credit rating changes.

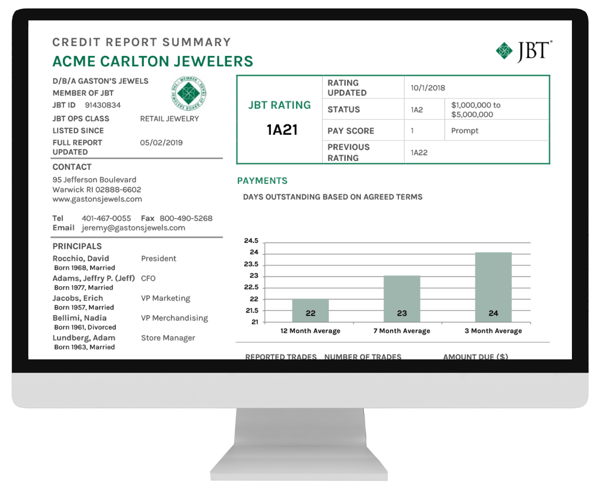

Next, consider ordering a credit report on your customers at least annually, if not more frequently. Credit reports include trending payment information for 12 Month Average, 6 Month Average, and 3 Month Average according to agreed-upon terms.

Whether you are a retailer operating storefront(s), an eCommerce store, or a wholesale supplier, leverage credit reporting and trade payment data to build secure partnerships. JBT offers up to 25 free credit reports each year based on membership type. If you are not yet a member, become a member today.

About Jewelers Board of Trade

For over 100 years, The Jewelers Board of Trade (JBT) has obtained and delivered business, credit, and trade data as a not-for-profit, member-owned trade association. Our data, numerous reports, and collection services help members make better business decisions every day of the year.

Today, our members comprise retailers (jewelers, non-specialist retailers) and wholesalers in the United States and Canada that supply the jewelry industry with goods and services. In addition, our members include international brands that service the jewelry industry.