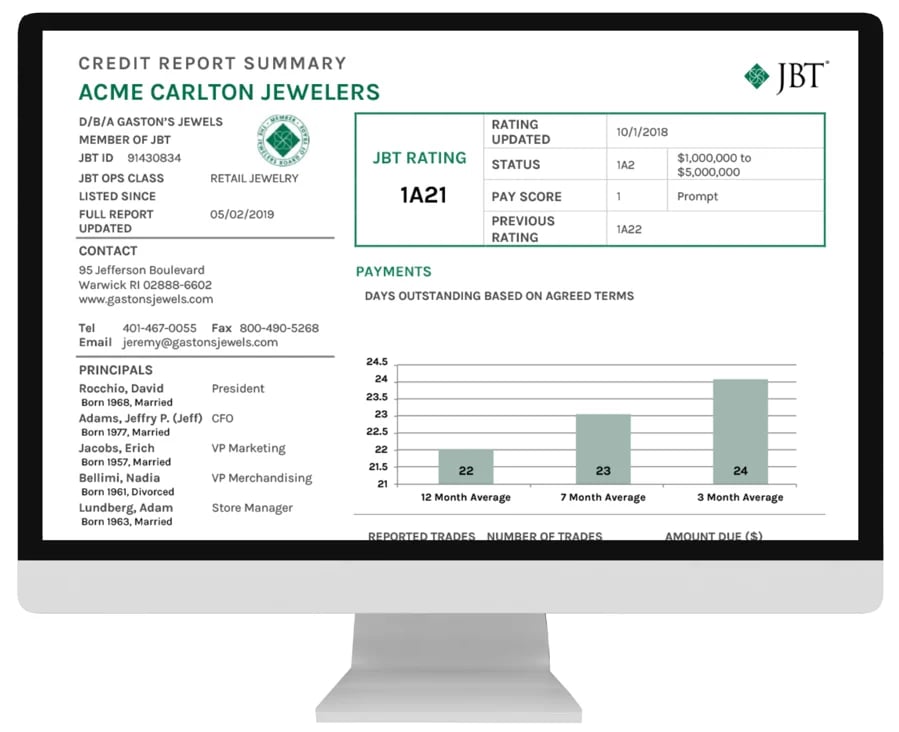

It's never a bad time to seek out business intelligence about your partners to assess your company's risk. With that said, it's also very possible that during the post-COVID industry boom, your due diligence on current or prospective partners waned, without much consequence to your business's health or bottom line. However, as we near Q4 of 2023, overall retail credit ratings are declining. This decline in healthy credit scores leads to increased risk for your business, making understanding your partners' financial health all the more essential. As Abe Sherman at BIG rightly assesses, "Monitoring JBT ratings, which hasn’t been much of a concern over the past couple of years, has become important once again."

Read his insightful article on this industry trend on his site. And, if you're hungry for the industry knowledge you need to make informed business decisions, contact us today to start your JBT Membership application.